Arizona vs Arizona State Prediction — AI Finds CAN'T MISS CFB Lines & Props (Nov 28)

Updated: 2025-11-21T02:28:40.156150ZBy Remi at Leans.AI — AI picks for ATS, ML, OU & props

The Wildcats travel to Tempe to face their in-state rival in a high-stakes Territorial Cup showdown, where Arizona will attempt to carry season-momentum into hostile territory and ASU will aim to defend home turf and reverse recent trends. Emotions, crowd energy and rivalry history are magnified in this scenario, making turnovers, early momentum and field-position swings likely decisive.

Get key insights, betting trends, and AI-powered predictions to help incorporate into your betting strategies.

GAME INFO

Date: Nov 28, 2025

Start Time: 10:00 PM EST

Venue: Mountain America Stadium

Sun Devils Record: (8-3)

Wildcats Record: (8-3)

OPENING ODDS

ARIZ Moneyline: -110

ARIZST Moneyline: -110

ARIZ Spread: -1.5

ARIZST Spread: +1.5

Over/Under: 48.5

ARIZ

Betting Trends

- Arizona enters the matchup with a respectable 7-4 record against the spread this season; however, in recent years when favored in this particular rivalry on the road at ASU, they have gone just 3-7 ATS.

ARIZST

Betting Trends

- Arizona State has covered the spread six times this season and has shown moderate ATS success at home, but their performance in tightly contested rivalry games has been inconsistent and vulnerable.

MATCHUP TRENDS

- Arizona being favored in Tempe is a rare occurrence—when it has happened over the last 13 meetings at Arizona State, the Wildcats were just 3-7 ATS—so this sets up value for the home team in the spread. Additionally, the over/under may lean toward the “under” as rivalry games often feature heightened emotion, defensive intensity and less offensive rhythm than normal, meaning score lines can stay tighter than public perception suggests.

ARIZ vs. ARIZST

Best Prop Bet

- Remi's searched hard and found the best prop for this matchup: N. Fifita under 225.5 Passing Yards.

LIVE CFB ODDS

CFB ODDS COMPARISON

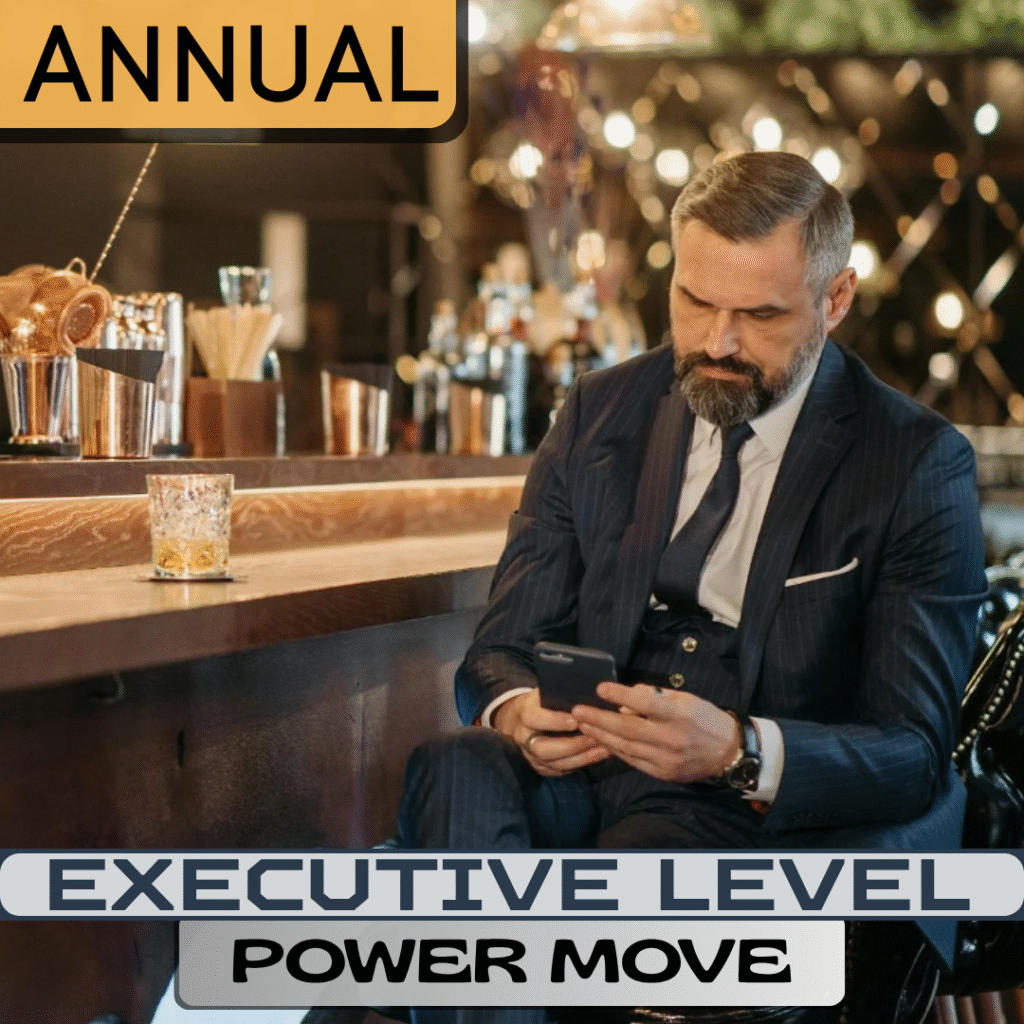

WANT MORE AI PICKS?

VS. SPREAD

374-287

NET UNITS

(INCL VIG & EXEC)

+829.4

NET PROFIT

(INCL VIG & EXEC)

$100/UNIT

$82,943

VS. SPREAD

1680-1416

NET UNITS

(INCL VIG)

+450.6

NET PROFIT

(INCL VIG)

$100/UNIT

$45,057

AI SPORTS PICK PRODUCTS

Create a Free Account

‘Create an Account’ to Get Remi’s Picks Today.

‘Create an Account’ to Get Remi’s Picks Today. Remi Finds New Picks

Remi calculates the probability a team will cover the line.

Remi calculates the probability a team will cover the line. Remi Works 24/7

Remi uses this probability to assign units to each pick.

Remi uses this probability to assign units to each pick.

Get Remi's AI Picks

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Hedge Meaning in Betting | 4 Obvious Times to Hedge

Learn about hedge betting to manage risk and secure profits. Understand...

What is a Push in Betting? | 3 Ways To Use To Your Advantage

Understand what a push in betting means, how it happens in...

What Does the + and – Mean in Sports Betting? | 5 Easy Tips

Learn the basics of sports betting odds, what the plus (+)...

Arizona vs Arizona State Prediction & Odds:

Free CFB Betting Insights for 11/28/25

The November 28, 2025 Territorial Cup matchup between the Arizona Wildcats and the Arizona State Sun Devils arrives with its usual weight of in-state pride, emotional volatility, and narrative-shifting potential, as both programs converge in Tempe with contrasting arcs yet equally urgent motivations to claim the rivalry’s momentum and close their regular seasons on a defining note. Arizona enters the contest with a surge of confidence built on its improved defensive performance, more efficient offensive execution, and a season that has showcased upward trajectory, including stronger trench play, steadier quarterback rhythm, and consistent production from key playmakers who have elevated the Wildcats’ floor in competitive games. Arizona State, meanwhile, embraces the familiar rivalry-day role of home underdog charged with protecting the symbolic ground of Sun Devil Stadium, leaning on the crowd impact, emotional surge, and the inherent chaos rivalry games often produce; their season has been marked by flashes of offensive potential and periods of vulnerability, but their athleticism and playmaking upside make them dangerous in spurts, particularly at home where tempo and energy can swing rapidly. Strategically the matchup centers around three core pillars: turnover margin, line-of-scrimmage control, and explosive-play containment. Arizona’s recent ATS success stems largely from protecting the football and creating shorter fields for its offense, and if they can replicate that discipline they can quiet the Tempe crowd early; ASU, however, thrives when forcing mistakes, generating quick-change plays, and feeding off momentum created by sacks, interceptions, or special-teams surges. In the trenches Arizona’s improved defensive front aims to limit ASU’s early-down rushing efficiency and force the Sun Devils into predictable passing downs where pressure packages can take over, while Arizona State’s defensive front must win leverage battles, stop Arizona’s balanced run-pass rhythm, and prevent the Wildcats from stacking early long drives that undermine the crowd energy.

Explosive plays often define this rivalry, and while Arizona has been better at limiting defensive lapses, they still must handle ASU’s vertical threats and misdirection concepts that can rapidly flip field position; conversely Arizona State must stay disciplined against Arizona’s increasingly confident passing attack and ensure that broken plays or scramble drills do not lead to downfield damage. Momentum is magnified in this rivalry: early scoring swings, third-down conversions, and red-zone success tend to dictate emotional control, and Arizona’s ability to maintain composure in a hostile venue will be as important as its schematic execution. Special teams also loom large, as hidden yards, kickoff coverage, and field-goal reliability frequently become decisive in Territorial Cup outcomes, especially in tightly contested defensive battles. From a psychological standpoint Arizona carries the pressure of sustaining upward momentum while confronting a historically unfavorable ATS profile when favored in Tempe, and ASU carries the motivation of playing spoiler, reclaiming pride, and leveraging home-field chaos. Ultimately the matchup hinges on whether Arizona can extend its season-long discipline into a rivalry cauldron and dictate tempo through balanced offense and strong defensive structure, or whether Arizona State can channel crowd energy, create turnovers, strike explosively, and turn the rivalry’s emotional currents into a decisive home-field advantage.

Get live CFB odds and precise AI CFB picks, predictions, and cover probabilities.

hat trick 🪄 pic.twitter.com/HuhvlQjoME

— Arizona Football (@ArizonaFBall) November 23, 2025

Arizona Wildcats CFB Preview

The Arizona Wildcats enter their November 28, 2025 road matchup against the Arizona State Sun Devils with upward momentum, renewed defensive identity, and the pressure of proving they can deliver in a rivalry environment that has historically unsettled even their better teams, and to succeed in Tempe they must blend discipline, composure, and execution while managing the emotional volatility unique to the Territorial Cup. Arizona arrives with a more complete team than in recent years, boasting a defense that has improved significantly in tackling efficiency, explosive-play prevention, and situational third-down execution, and the Wildcats must rely on that defensive reliability to neutralize Arizona State’s sporadic but dangerous playmaking ability, especially in a home setting where crowd surges can magnify any breakdowns. The Wildcats must prioritize winning early downs, forcing ASU into long passing situations, and preventing the Sun Devils from generating the chunk plays that often flip rivalry games; maintaining gap integrity, avoiding communication errors in the secondary, and tackling cleanly in space will be essential against an ASU offense that leans heavily on rhythm and emotional momentum. Offensively Arizona must carry over the efficiency gains that have characterized their season: sustaining structured drives, protecting the football, leveraging balanced run-pass sequences, and ensuring their quarterback makes smart, controlled decisions rather than forcing deep shots into coverage that can ignite the Sun Devil Stadium crowd. Establishing the run early is especially important, because doing so stabilizes the offense, slows down ASU’s pass rush, and increases the Wildcats’ ability to dictate pace; meanwhile, the passing game must focus on precision and timing, minimizing high-variance throws that rivalry tension often tempts quarterbacks into.

Arizona must also handle situational football with playoff-like seriousness: converting red-zone opportunities into touchdowns instead of settling for field goals, avoiding pre-snap penalties that derail drives, and controlling field position—particularly through disciplined special teams play that does not give ASU short fields or momentum-shifting returns. Emotionally the Wildcats must strike a delicate balance between urgency and restraint: they must match the rivalry intensity without allowing it to push them into mistakes, and leadership from veteran players will be critical in keeping composure through noise, adversity, and unpredictable rivalry swings. Arizona’s historical ATS struggles when favored in Tempe add another layer of psychological pressure, meaning they must outperform the weight of expectation with poise rather than leaning solely on talent advantage. For the Wildcats to maximize their road potential, they must eliminate turnovers, win the hidden-yardage battle, respond quickly to ASU scoring drives, and maintain trust in their game plan rather than shifting into panic mode if early momentum breaks against them. Ultimately Arizona’s path to winning away from home lies in controlling tempo, neutralizing explosive ASU plays, sustaining efficient offense, dominating situational moments, and demonstrating the mental toughness required to thrive in one of the most emotionally charged rivalry environments in college football.

Credit: USA TODAY/IMAGN

Arizona State Sun Devils CFB Preview

The Arizona State Sun Devils enter their November 28, 2025 home showdown against the Arizona Wildcats with the emotional weight, historical pride, and situational urgency that come with hosting the Territorial Cup, a rivalry that magnifies every possession, heightens every mistake, and often brings out performances far removed from either team’s season-long rhythm, and ASU knows this game represents an opportunity to reclaim bragging rights, salvage momentum, and disrupt Arizona’s rise by leveraging home-field advantage, crowd intensity, and their own flashes of explosive potential. Playing in Tempe gives the Sun Devils a tangible edge, as their energy, tempo, and defensive confidence traditionally spike at home, and they must channel that advantage into early and sustained pressure that forces Arizona into uncomfortable situations, because the Wildcats have struggled historically as road favorites in this rivalry. Offensively ASU must strike a balance between aggression and discipline, using early-down diversity—mixing inside zone, perimeter runs, and quick-strike routes—to keep Arizona’s improving defense off balance while also hunting for explosive opportunities through play action or downfield shots that can galvanize the stadium. Their quarterback must remain poised, avoid forced throws, and prioritize ball security while still providing enough vertical threat to prevent Arizona from crowding the short and intermediate zones. The Sun Devils’ offensive line must win leverage battles, create clean run lanes, and prevent Arizona’s defensive front from dictating tempo or collapsing the pocket, because ASU is at its best when its playmakers get the ball in space with room to maneuver rather than being forced into predictable, long-yardage situations.

Defensively ASU must prepare for an Arizona offense that has grown more efficient, more balanced, and more comfortable operating under pressure, and the Sun Devils must counter with disciplined coverage, strong tackling fundamentals, and an aggressive but controlled pass rush that disrupts timing without sacrificing containment. The key defensively lies in winning early downs, as forcing Arizona into third-and-longs not only plays into ASU’s defensive strength but also energizes the crowd and shifts momentum toward the home sideline; additionally, ASU must emphasize eliminating explosive plays and preventing Arizona from sustaining long, demoralizing drives that flatten crowd impact. Special teams will be a major hinge point, as rivalry games often turn on field-position swings, coverage breakdowns, or clutch kicking moments, and ASU must ensure they gain ground in the hidden-yardage battle through disciplined operation. Emotionally the Sun Devils must harness the rivalry’s intensity without letting it push them into unnecessary penalties or overextensions, and leadership within the locker room will be essential in balancing confidence with control. Ultimately ASU’s path to victory lies in establishing early momentum, protecting the football, generating explosive plays, and leveraging the crowd’s influence to force Arizona out of rhythm; if the Sun Devils can dominate key moments, sustain defensive pressure, win the trenches, and capitalize on Arizona’s historical challenges when favored in Tempe, they give themselves every opportunity to reclaim the Territorial Cup on their home field.

Production on display 👀

— Sun Devil Football (@ASUFootball) November 24, 2025

A look at @raleek2 numbers in game 11 pic.twitter.com/Woe0wO9jZ7

Arizona vs Arizona State Prop Picks (AI)

Remi is pouring through tons of stats on each team. In fact, anytime the Wildcats and Sun Devils play there’s always several intriguing trends to key in on. Not to mention games played at Mountain America Stadium in Nov rarely follow normal, predictable patterns.

Arizona vs Arizona State Prediction (AI)

Remi, our AI sports genius, has been pouring over mountains of data from every past game between the Wildcats and Sun Devils and using recursive machine learning and industry leading AI to crunch the data to a single cover probability.

Remi has been most keyed in on the growing weight human bettors often put on coaching factors between a Wildcats team going up against a possibly deflated Sun Devils team. It appears the true game analytics appear to reflect a slight lean against one Vegas line in particular.

Unlock this in-depth AI prediction and all of our CFB AI picks for FREE now.

Below is our current AI Arizona vs Arizona State picks, computer picks Wildcats vs Sun Devils, best bets, model edges, confidence ratings.

| DATE | GAME | LEAN | %WIN | UNITS | LEVEL | |

|---|---|---|---|---|---|---|

| ACTIVE PICKS LOCKED - SEE NOW | ||||||

These picks update as information changes—injury reports, and market movement. Each line shows our model’s fair price, the edge versus the market, and a unit confidence rating (1–10). Odds and availability vary by sportsbook and time. Edges are computed against the listed price; value may change after line moves. Always shop for the best number. See the full CFB schedule.

Arizona Betting Trends

Arizona enters the matchup with a respectable 7-4 record against the spread this season; however, in recent years when favored in this particular rivalry on the road at ASU, they have gone just 3-7 ATS.

Arizona State Betting Trends

Arizona State has covered the spread six times this season and has shown moderate ATS success at home, but their performance in tightly contested rivalry games has been inconsistent and vulnerable.

Wildcats vs. Sun Devils Matchup Trends

Arizona being favored in Tempe is a rare occurrence—when it has happened over the last 13 meetings at Arizona State, the Wildcats were just 3-7 ATS—so this sets up value for the home team in the spread. Additionally, the over/under may lean toward the “under” as rivalry games often feature heightened emotion, defensive intensity and less offensive rhythm than normal, meaning score lines can stay tighter than public perception suggests.

Arizona vs. Arizona State Game Info

Arizona vs Arizona State starts on November 28, 2025 at 10:00 PM EST.

Venue: Mountain America Stadium.

Spread: Arizona State +1.5

Moneyline: Arizona -110, Arizona State -110

Over/Under: 48.5

Arizona: (8-3) | Arizona State: (8-3)

Remi's searched hard and found the best prop for this matchup: N. Fifita under 225.5 Passing Yards.. Prices move—always shop for the best number.

Arizona being favored in Tempe is a rare occurrence—when it has happened over the last 13 meetings at Arizona State, the Wildcats were just 3-7 ATS—so this sets up value for the home team in the spread. Additionally, the over/under may lean toward the “under” as rivalry games often feature heightened emotion, defensive intensity and less offensive rhythm than normal, meaning score lines can stay tighter than public perception suggests.

ARIZ trend: Arizona enters the matchup with a respectable 7-4 record against the spread this season; however, in recent years when favored in this particular rivalry on the road at ASU, they have gone just 3-7 ATS.

ARIZST trend: Arizona State has covered the spread six times this season and has shown moderate ATS success at home, but their performance in tightly contested rivalry games has been inconsistent and vulnerable.

See our latest CFB picks and odds pages for 2025 to compare prices before you bet.

Arizona vs. Arizona State Odds

AI algorithm Remi is pouring through tons of data points on each player. In fact, anytime the Arizona vs Arizona State trends are analyzed, there’s always several intriguing trends to key in on. Not to mention games played at extreme altitude seemingly never follow normal, predictable betting trends.

| ARIZ Moneyline | -110 |

|---|---|

| ARIZST Moneyline | -110 |

| ARIZ Spread | -1.5 |

| ARIZST Spread | +1.5 |

| Over / Under | 48.5 |

Arizona vs Arizona State Live Odds

| Games | PTS | ML | SPR | O/U | |

|---|---|---|---|---|---|

|

Dec 5, 2025 7:00PM EST

Troy Trojans

James Madison Dukes

12/5/25 7PM

TROY

JMAD

|

–

–

|

+1258

-5049

|

+23.5 (-110)

-23.5 (-110)

|

O 47 (-110)

U 47 (-110)

|

|

|

Dec 5, 2025 7:00PM EST

Kennesaw State Owls

Jacksonville State Gamecocks

12/5/25 7PM

KENSAW

JAXST

|

–

–

|

-138

+112

|

-2.5 (-110)

+2.5 (-110)

|

O 60.5 (-110)

U 60.5 (-110)

|

|

|

Dec 5, 2025 8:00PM EST

North Texas Mean Green

Tulane Green Wave

12/5/25 8PM

NOTEX

TULANE

|

–

–

|

-136

+111

|

-2.5 (-110)

+2.5 (-110)

|

O 66.5 (-110)

U 66.5 (-110)

|

|

|

Dec 5, 2025 8:01PM EST

UNLV Rebels

Boise State Broncos

12/5/25 8:01PM

UNLV

BOISE

|

–

–

|

+170

-212

|

+5 (-110)

-5 (-110)

|

O 59 (-110)

U 59 (-110)

|

|

|

Dec 6, 2025 12:00PM EST

Miami Ohio Redhawks

Western Michigan Broncos

12/6/25 12PM

MIAOH

WMICH

|

–

–

|

-128

|

-2 (-110)

|

O 43.5 (-110)

U 43.5 (-110)

|

|

|

Dec 6, 2025 12:00PM EST

BYU Cougars

Texas Tech Red Raiders

12/6/25 12PM

BYU

TXTECH

|

–

–

|

+380

-526

|

+12.5 (-110)

-12.5 (-110)

|

O 49.5 (-110)

U 49.5 (-110)

|

|

|

Dec 6, 2025 4:00PM EST

Georgia Bulldogs

Alabama Crimson Tide

12/6/25 4PM

UGA

BAMA

|

–

–

|

-130

+106

|

-2 (-110)

+2 (-110)

|

O 48 (-110)

U 48 (-110)

|

|

|

Dec 6, 2025 8:00PM EST

Duke Blue Devils

Virginia Cavaliers

12/6/25 8PM

DUKE

UVA

|

–

–

|

+151

-187

|

+4 (-110)

-4 (-110)

|

O 58 (-110)

U 58 (-110)

|

|

|

Dec 6, 2025 8:01PM EST

Indiana Hoosiers

Ohio State Buckeyes

12/6/25 8:01PM

IND

OHIOST

|

–

–

|

+160

-199

|

+4 (-110)

-4 (-110)

|

O 48 (-110)

U 48 (-110)

|

|

|

Dec 13, 2025 3:00PM EST

Army Black Knights

Navy Midshipmen

12/13/25 3PM

ARMY

NAVY

|

–

–

|

+172

-216

|

+4.5 (-105)

-4.5 (-115)

|

O 39 (-110)

U 39 (-110)

|

CFB Past Picks

Remi—our in-house AI—prices every game and prop using multi-season priors, tempo/efficiency, injury/usage signals, and market movement.

We publish fair prices, recommended “buy-to” numbers, and confidence so you can bet prices, not teams.

This preview covers Arizona Wildcats vs. Arizona State Sun Devils on November 28, 2025 at Mountain America Stadium.

Odds shown reflect widely available numbers and may update closer to kickoff.

Want more? Check live edges, player props, and line moves on our CFB odds pages, and compare prices before you place a bet.

| LEAN | %WIN | UNITS | RESULT | |

|---|---|---|---|---|

| COLO@KSTATE | COLO +17.5 | 54.0% | 4 | WIN |

| PSU@RUT | RUT +14 | 52.8% | 1 | WIN |

| OHIOST@MICH | MICH +10.5 | 56.4% | 6 | LOSS |

| VATECH@UVA | VATECH +8 | 57.8% | 7 | LOSS |

| NWEST@ILL | LUKE ALTMYER UNDER 19.5 PASS COMP | 54.3% | 4 | WIN |

| ORE@WAS | DEMOND WILLIAMS JR UNDER 43.5 RUSH YDS | 55.2% | 5 | WIN |

| MIAMI@VATECH | VATECH +18.5 | 54.2% | 4 | WIN |

| GAST@TROY | TROY -9.5 | 55.7% | 5 | WIN |

| DEL@WAKE | DEL +18 | 56.7% | 6 | LOSS |

| NMEX@AF | NMEX -3.5 | 56.1% | 5 | WIN |

| WASHST@JMAD | WASHST +14.5 | 55.3% | 5 | WIN |

| ILL@WISC | WISC +9 | 55.1% | 5 | WIN |

| WKY@LSU | WKY +23.5 | 56.3% | 6 | WIN |

| WASH@UCLA | DEMOND WILLIAMS UNDER 27.5 PASS ATT | 56.3% | 6 | WIN |

| TCU@HOU | AMARE THOMAS OVER 69.5 RECV YDS | 55.2% | 5 | WIN |

| TEX@UGA | NATE FRAZIER UNDER 65.5 RUSH + REC YDS | 55.5% | 5 | WIN |

| PUR@WASH | ANTONIO HARRIS UNDER 73.5 RUSH + REC YDS | 54.1% | 4 | WIN |

| OKLA@BAMA | UNDER 46 | 52.4% | 2 | WIN |

| UVA@DUKE | DUKE -3.5 | 54.7% | 3 | LOSS |

| OKLA@BAMA | BAMA -6 | 54.5% | 3 | LOSS |

| OREGST@TULSA | OREGST -120 | 55.6% | 5 | LOSS |

| UTEP@MIZZST | MIZZST -5 | 54.3% | 4 | WIN |

| COLOST@NMEX | NMEX -14 | 57.1% | 6 | LOSS |

| PSU@MICHST | MICHST +7.5 | 56.5% | 6 | LOSS |

| MISSST@MIZZOU | MISSST +7.5 | 57.2% | 7 | LOSS |

| FAU@TULANE | FAU +17.5 | 56.0% | 6 | WIN |

| NCST@MIAMI | NCST +15.5 | 57.1% | 7 | LOSS |

| KENTST@AKRON | AKRON -6.5 | 55.4% | 5 | LOSS |

| JAXST@UTEP | JAXST -105 | 57.0% | 7 | WIN |

| FSU@CLEM | CLEM -118 | 57.1% | 5 | WIN |

| UNLV@COLOST | UNLV -4 | 55.2% | 5 | WIN |

| OREG@IOWA | IOWA +6.5 | 53.3% | 2 | WIN |

| NEB@UCLA | NEB +1.5 | 55.8% | 5 | WIN |

| KENSAW@NMEXST | NMEXST +10 | 56.5% | 6 | WIN |

| STNFRD@UNC | STNFRD +7.5 | 53.8% | 3 | WIN |

| DUKE@UCONN | UCONN +8.5 | 57.9% | 7 | WIN |

| NEVADA@UTAHST | NEVADA +9.5 | 55.9% | 5 | LOSS |

| SAMST@OREGST | SAMST +21 | 57.7% | 7 | WIN |

| NEB@UCLA | NICO IAMALEAVA UNDER 180.5 PASS YDS | 56.6% | 6 | LOSS |

| HOU@UCF | HOU -112 | 58.0% | 6 | WIN |

| GASTHRN@APPST | GASTHRN +180 | 36.5% | 2 | WIN |

| KENTST@BALLST | BALLST -2.5 | 54.5% | 4 | WIN |

| WAKE@FSU | WAKE +10.5 | 56.4% | 6 | LOSS |

| WYO@SDGST | SDGST -10.5 | 56.7% | 7 | WIN |

| OKLA@TENN | TENN -130 | 58.3% | 5 | LOSS |

| GATECH@NCST | GATECH -5 | 56.4% | 6 | LOSS |

| MIAMI@SMU | MIAMI -10 | 54.3% | 4 | LOSS |

| IND@MD | MD +21.5 | 54.6% | 4 | LOSS |

| CINCY@UTAH | CINCY +11 | 57.6% | 7 | LOSS |

| OLDDOM@LAMON | LAMON +17 | 58.4% | 8 | LOSS |

| VANDY@TEXAS | OVER 46.5 | 53.7% | 2 | WIN |