Duke vs North Carolina Prediction — AI Finds CAN'T MISS CFB Lines & Props (Nov 22)

Updated: 2025-11-15T02:28:40.156150ZBy Remi at Leans.AI — AI picks for ATS, ML, OU & props

The Duke Blue Devils visit the North Carolina Tar Heels on November 22, 2025 in an ACC rivalry game with major implications for both teams’ seasons. Duke brings an explosive offense and improving profile, while UNC enters under new leadership and seeks momentum at home.

Get key insights, betting trends, and AI-powered predictions to help incorporate into your betting strategies.

GAME INFO

Date: Nov 22, 2025

Start Time: 4:30 PM EST

Venue: Kenan Stadium

Tar Heels Record: (4-6)

Blue Devils Record: (5-5)

OPENING ODDS

DUKE Moneyline: -254

UNC Moneyline: +204

DUKE Spread: -6.5

UNC Spread: +6.5

Over/Under: 51.5

DUKE

Betting Trends

- Duke currently averages about 35.2 points per game (22nd nationally) but allows roughly 29.1 points per game—indicating that while the offense is high powered, the defense has been vulnerable and the Blue Devils have frequently been involved in high-scoring, tight contests.

UNC

Betting Trends

- North Carolina is averaging just 18.7 points per game while allowing 22.0 points per game, among the lowest scoring offenses in the FBS this season—a profile that suggests limited upside and may raise red flags for backing them heavily as favorites.

MATCHUP TRENDS

- Given Duke’s high-scoring offense versus UNC’s low-scoring offense and moderate defense, the spread likely favors Duke but the total could be intriguing: if Duke drives tempo and UNC can’t generate much, the total might lean under expectations for a “power rivalry” game. Additionally, Duke as an away team with explosive offense but inconsistent defense offers value for covering, while UNC’s home advantage may matter less if they remain limited offensively.

DUKE vs. UNC

Best Prop Bet

- Remi's searched hard and found the best prop for this matchup: Q. Brown over 48.5 Receiving Yards.

LIVE CFB ODDS

CFB ODDS COMPARISON

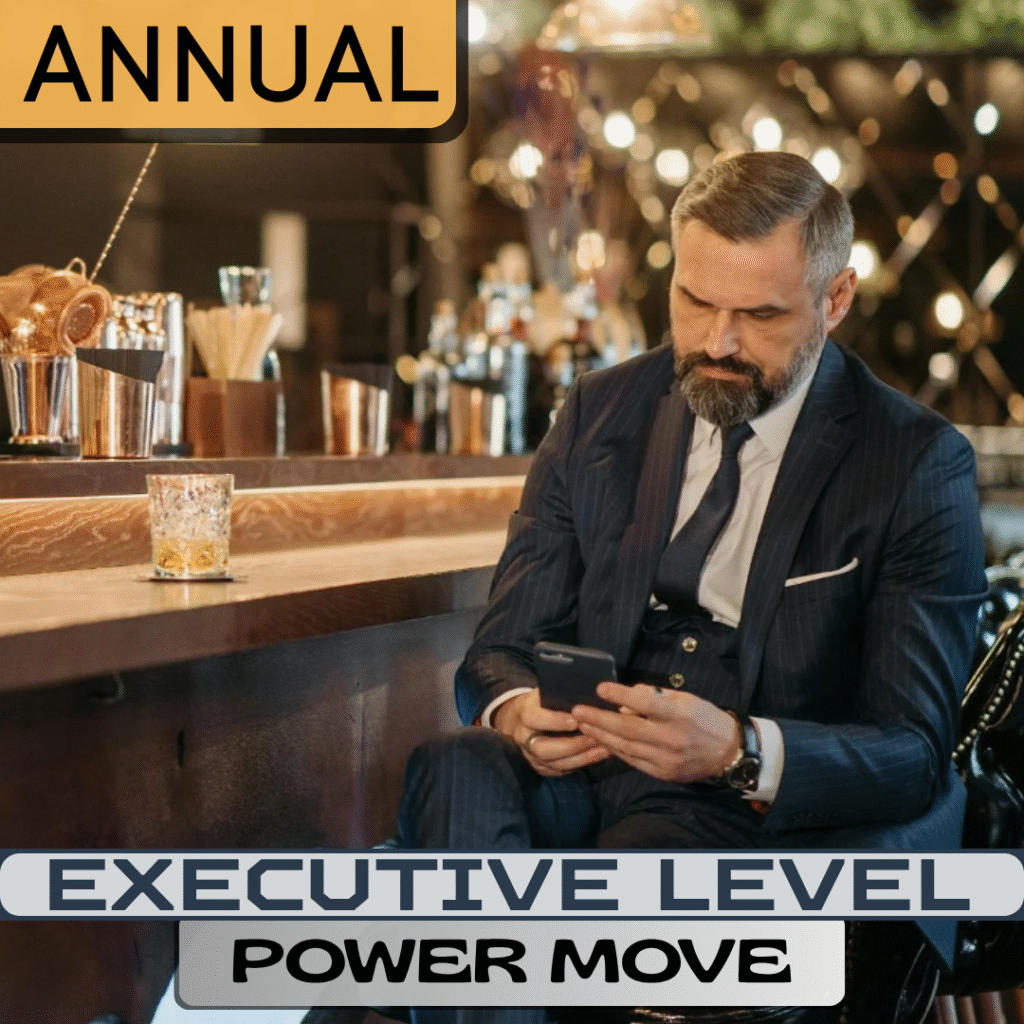

WANT MORE AI PICKS?

VS. SPREAD

465-382

NET UNITS

(INCL VIG & EXEC)

+915

NET PROFIT

(INCL VIG & EXEC)

$100/UNIT

$91,496

VS. SPREAD

2010-1627

NET UNITS

(INCL VIG)

+612.4

NET PROFIT

(INCL VIG)

$100/UNIT

$61,240

AI SPORTS PICK PRODUCTS

Create a Free Account

‘Create an Account’ to Get Remi’s Picks Today.

‘Create an Account’ to Get Remi’s Picks Today. Remi Finds New Picks

Remi calculates the probability a team will cover the line.

Remi calculates the probability a team will cover the line. Remi Works 24/7

Remi uses this probability to assign units to each pick.

Remi uses this probability to assign units to each pick.

Get Remi's AI Picks

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Hedge Meaning in Betting | 4 Obvious Times to Hedge

Learn about hedge betting to manage risk and secure profits. Understand...

What is a Push in Betting? | 3 Ways To Use To Your Advantage

Understand what a push in betting means, how it happens in...

What Does the + and – Mean in Sports Betting? | 5 Easy Tips

Learn the basics of sports betting odds, what the plus (+)...

Duke vs North Carolina Prediction & Odds:

Free CFB Betting Insights for 11/22/25

The November 22, 2025 rivalry matchup between Duke and North Carolina arrives with two programs entering from sharply different competitive angles, shaping a contest built on tempo, efficiency, and the emotional weight that defines one of the ACC’s most enduring in-state battles, as Duke brings one of the conference’s more explosive offenses while North Carolina continues to grind through a season defined by inconsistent scoring, limited big-play production, and a defense that has been asked to absorb far more strain than its structure was designed to handle. Duke’s scoring output in the mid-30s reflects a unit capable of stretching defenses horizontally and vertically, generating explosive passing plays, and sequencing drives with rhythm when its quarterback and receivers operate in sync; the Blue Devils combine a productive aerial attack with enough run-game presence to prevent defenses from selling out against one dimension, allowing them to dictate tempo and force opponents into uncomfortable coverage shells. Their defensive weakness, however, has been a recurring storyline: surrendering nearly 30 points per game, Duke often gives opponents opportunities to stay within possession range, making their offensive precision essential to maintaining control. North Carolina, in contrast, enters with an offense averaging under 20 points per game, a figure that reflects a season-long struggle to sustain drives, generate consistent push at the line of scrimmage, or finish scoring opportunities; the Tar Heels’ passing game has been inconsistent, the run game often inefficient, and their third-down conversion rate among the lower tiers of the conference. Their defense, while steadier than the offense, has also faced persistent pressure due to short rest cycles and limited offensive support, creating a cyclical challenge where long stretches of field time lead to worn-down late-game execution.

The strategic heartbeat of this matchup revolves around Duke’s ability to start fast and force UNC into catch-up mode; if the Blue Devils establish early vertical threats or mid-range timing routes, they can spread UNC thin and accelerate the pace toward a game script the Tar Heels are ill-equipped to match. Conversely, North Carolina must slow the game dramatically, leaning on field-position control, conservative but efficient drives, and defensive discipline to force Duke into extended possessions where mistakes or stalled sequences can accumulate. Special teams loom large in a rivalry with emotional volatility—each hidden-yardage swing, punt pin, or missed assignment may determine whether UNC can keep Duke from breaking the game open. Turnovers also carry amplified weight: Duke’s offense thrives when clean, but any early disruptions could energize a home crowd eager for a rivalry spark. For North Carolina, the key is to avoid falling behind by multiple scores, because their offensive structure does not support rapid comeback football; they must stay within one possession long enough for pressure to shift to Duke’s defense. Ultimately, Duke enters with the clearer set of advantages—superior scoring capability, stronger quarterback play, and a ceiling UNC cannot match in a high-tempo environment—yet rivalry games often bend toward emotion, discipline, and unexpected momentum swings. If Duke maintains rhythm and avoids defensive lapses, they control the matchup; if UNC drags this into a low-possession, field-position grinder, the rivalry could deliver tension deeper into the fourth quarter than statistics alone would predict.

Get live CFB odds and precise AI CFB picks, predictions, and cover probabilities.

👏 @LukeMergott pic.twitter.com/a2pBTMvOCX

— Duke Football (@DukeFOOTBALL) November 18, 2025

Duke Blue Devils CFB Preview

Duke enters its November 22, 2025 road rivalry matchup at North Carolina with one of the ACC’s more explosive offensive identities, a scoring average in the mid-30s, and a quarterback-driven attack that has consistently produced chunk plays, sustained drives, and multi-score surges capable of flipping game scripts quickly—even as their defensive volatility has forced them to rely heavily on offensive precision to stay ahead of opponents. The Blue Devils’ passing attack, responsible for more than 3,000 yards on the season, thrives on timing routes, layered concepts, and aggressive vertical strikes that stress opposing secondaries and open the field for complementary run-game sequencing. On the ground, Duke has generated enough production to prevent defenses from committing fully to coverage, resulting in more favorable third-down situations and allowing their coordinator to maintain his full playbook throughout games. Against a North Carolina defense that has been functional but inconsistent, Duke’s offense holds significant advantage—particularly if they start fast and strike early, forcing the Tar Heels into a game script their struggling offense is ill-equipped to manage. Defensively, Duke remains the wild card: surrendering nearly 30 points per game, the Blue Devils have been prone to miscommunication in the secondary, over-pursuit at the second level, and difficulties defending tempo, all of which present opportunities for opponents even when outmatched.

Their task on the road will be to avoid giving UNC short fields or momentum swings through missed tackles or assignment breakdowns, especially because rivalry environments amplify mistakes and energize the home crowd. Special teams will also play a critical role in Duke’s ability to maintain control—they must avoid hidden-yardage losses, protect field position, and ensure their aggressive offensive identity isn’t negated by soft coverage or inconsistent kicking. Psychologically, Duke arrives with confidence in its offense but must manage the emotional volatility of a rivalry game, resisting the temptation to force big plays prematurely while also maintaining the tempo advantages that have defined their success. Their clearest path to victory is straightforward: impose their pace early, maintain offensive rhythm, protect the football, and limit UNC’s opportunities to shorten the game. If Duke executes with discipline and keeps the pressure on UNC’s offense to respond drive for drive, the Blue Devils’ talent and scoring ceiling should give them control of the contest. But if their defense collapses early or the offense stalls long enough to allow North Carolina’s conservative style to dictate tempo, the game could tighten and create late-game pressure on a unit more accustomed to leading than chasing.

Credit: USA TODAY/IMAGN

North Carolina Tar Heels CFB Preview

North Carolina enters its November 22, 2025 home rivalry matchup against Duke seeking stability, discipline, and a game script tailored to compensate for an offense that has struggled all season, averaging under 20 points per game and ranking near the bottom of the ACC in yards per play, red-zone efficiency, and explosive-play rate. Playing in Chapel Hill gives the Tar Heels their most meaningful leverage—crowd energy, familiar rhythm, and the ability to dictate early pace—but they must align that advantage with execution in all three phases to counter a Duke team that brings one of the conference’s highest-scoring offenses and a tempo that can turn modest mistakes into multi-score swings. For UNC, the formula begins with slowing the game dramatically: long, methodical drives built around efficient short passing, controlled runs, and high-percentage throws designed to protect the football and reduce total possessions. Their offense has struggled to generate explosive gains, making early-down success essential to prevent Duke from forcing predictable passing situations, where the Tar Heels have been inconsistent in protection and route timing. Defensively, UNC must elevate its performance decisively—containing Duke’s vertical passing game, tightening underneath zones, and winning first-down battles to force Duke into slower, more deliberate drives that reduce their scoring efficiency. Assignment discipline will be crucial, as Duke excels at exploiting mismatches, pre-snap leverage, and coverage breakdowns with layered route concepts and timing throws.

The Tar Heels also need their pass rush to affect Duke’s quarterback without overcommitting, as missed tackles or lost integrity on the edges can open big-play lanes. Special teams represent another area where UNC must hold strong: field-position swings, punt placement, kick coverage, and red-zone kicking accuracy could determine whether the Tar Heels can extend drives and shrink Duke’s explosive potential. Psychologically, UNC must embrace the underdog role without slipping into urgency-induced mistakes; they need to keep the crowd engaged, avoid early turnovers, and maintain a possession-focused style that forces Duke to operate in a compressed game rather than the open-track environment where the Blue Devils excel. Their path to victory is narrow but viable with proper discipline—control possession, stay within one score deep into the second half, and rely on defensive stands to limit Duke’s quick-strike capacity. If North Carolina can drag the contest into a slower, field-position battle, their defense has a chance to create pressure on Duke’s inconsistent defensive unit; but if they allow Duke to dictate tempo early or give up explosive plays, the Tar Heels’ limited offensive ceiling will make a comeback unlikely.

It’s about this seniors this week.🩵@mlombardiuncgm pic.twitter.com/V7UrKPkzug

— Carolina Football (@UNCFootball) November 18, 2025

Duke vs North Carolina Prop Picks (AI)

Remi is pouring through loads of data on each team. In fact, anytime the Blue Devils and Tar Heels play there’s always several intriguing angles to key in on. Not to mention games played at Kenan Stadium in Nov can often follow normal, predictable patterns.

Duke vs North Carolina Prediction (AI)

Remi, our AI sports genius, has been pouring over exorbitant amounts of data from every past game between the Blue Devils and Tar Heels and using recursive machine learning and impressive AI to boil down the data to a single cover probability.

The Algorithm has been most keyed in on the linear correlation of factor human bettors regularly put on player performance factors between a Blue Devils team going up against a possibly strong Tar Heels team. In reality, the true game analytics might reflect a strong lean against one Vegas line in particular.

Unlock this in-depth AI prediction and all of our CFB AI picks for FREE now.

Below is our current AI Duke vs North Carolina picks, computer picks Blue Devils vs Tar Heels, best bets, model edges, confidence ratings.

| DATE | GAME | LEAN | %WIN | UNITS | LEVEL | |

|---|---|---|---|---|---|---|

| ACTIVE PICKS LOCKED - SEE NOW | ||||||

These picks update as information changes—injury reports, and market movement. Each line shows our model’s fair price, the edge versus the market, and a unit confidence rating (1–10). Odds and availability vary by sportsbook and time. Edges are computed against the listed price; value may change after line moves. Always shop for the best number. See the full CFB schedule.

Duke Betting Trends

Duke currently averages about 35.2 points per game (22nd nationally) but allows roughly 29.1 points per game—indicating that while the offense is high powered, the defense has been vulnerable and the Blue Devils have frequently been involved in high-scoring, tight contests.

North Carolina Betting Trends

North Carolina is averaging just 18.7 points per game while allowing 22.0 points per game, among the lowest scoring offenses in the FBS this season—a profile that suggests limited upside and may raise red flags for backing them heavily as favorites.

Blue Devils vs. Tar Heels Matchup Trends

Given Duke’s high-scoring offense versus UNC’s low-scoring offense and moderate defense, the spread likely favors Duke but the total could be intriguing: if Duke drives tempo and UNC can’t generate much, the total might lean under expectations for a “power rivalry” game. Additionally, Duke as an away team with explosive offense but inconsistent defense offers value for covering, while UNC’s home advantage may matter less if they remain limited offensively.

Duke vs. North Carolina Game Info

Duke vs North Carolina starts on November 22, 2025 at 4:30 PM EST.

Venue: Kenan Stadium.

Spread: North Carolina +6.5

Moneyline: Duke -254, North Carolina +204

Over/Under: 51.5

Duke: (5-5) | North Carolina: (4-6)

Remi's searched hard and found the best prop for this matchup: Q. Brown over 48.5 Receiving Yards.. Prices move—always shop for the best number.

Given Duke’s high-scoring offense versus UNC’s low-scoring offense and moderate defense, the spread likely favors Duke but the total could be intriguing: if Duke drives tempo and UNC can’t generate much, the total might lean under expectations for a “power rivalry” game. Additionally, Duke as an away team with explosive offense but inconsistent defense offers value for covering, while UNC’s home advantage may matter less if they remain limited offensively.

DUKE trend: Duke currently averages about 35.2 points per game (22nd nationally) but allows roughly 29.1 points per game—indicating that while the offense is high powered, the defense has been vulnerable and the Blue Devils have frequently been involved in high-scoring, tight contests.

UNC trend: North Carolina is averaging just 18.7 points per game while allowing 22.0 points per game, among the lowest scoring offenses in the FBS this season—a profile that suggests limited upside and may raise red flags for backing them heavily as favorites.

See our latest CFB picks and odds pages for 2025 to compare prices before you bet.

Duke vs. North Carolina Odds

Remi is pouring through loads of data points on each line. In fact, anytime the Duke vs North Carolina trends are analyzed, there’s always several intriguing trends to key in on. Not to mention games played at extreme travel distance seemingly never follow normal, predictable betting trends.

| DUKE Moneyline | -254 |

|---|---|

| UNC Moneyline | +204 |

| DUKE Spread | -6.5 |

| UNC Spread | +6.5 |

| Over / Under | 51.5 |

Duke vs North Carolina Live Odds

| Games | PTS | ML | SPR | O/U | |

|---|---|---|---|---|---|

|

Aug 29, 2026 12:00PM EDT

NC State Wolfpack

Virginia Cavaliers

8/29/26 12PM

NCST

UVA

|

–

–

|

+146

-176

|

+3.5 (-105)

-3.5 (-115)

|

O 54.5 (-105)

U 54.5 (-115)

|

|

|

Aug 29, 2026 12:00PM EDT

North Carolina Tar Heels

TCU Horned Frogs

8/29/26 12PM

UNC

TCU

|

–

–

|

+245

-310

|

+7.5 (-110)

-7.5 (-110)

|

O 50.5 (-105)

U 50.5 (-115)

|

|

|

Sep 5, 2026 12:00PM EDT

Clemson Tigers

LSU Tigers

9/5/26 12PM

CLEM

LSU

|

–

–

|

+350

-465

|

+11.5 (-110)

-11.5 (-110)

|

O 51.5 (-110)

U 51.5 (-110)

|

|

|

Sep 5, 2026 12:00PM EDT

UCLA Bruins

California Golden Bears

9/5/26 12PM

UCLA

CAL

|

–

–

|

+140

-170

|

+3.5 (-112)

-3.5 (-108)

|

O 53.5 (-110)

U 53.5 (-110)

|

|

|

Sep 5, 2026 12:00PM EDT

Baylor Bears

Auburn Tigers

9/5/26 12PM

BAYLOR

AUBURN

|

–

–

|

+235

-295

|

+7.5 (-114)

-7.5 (-106)

|

O 58.5 (-110)

U 58.5 (-110)

|

|

|

Sep 6, 2026 12:00PM EDT

Wisconsin Badgers

Notre Dame Fighting Irish

9/6/26 12PM

WISC

ND

|

–

–

|

+660

-1050

|

+16.5 (-105)

-16.5 (-115)

|

O 46.5 (-115)

U 46.5 (-105)

|

|

|

Sep 12, 2026 12:00PM EDT

Ohio State Buckeyes

Texas Longhorns

9/12/26 12PM

OHIOST

TEXAS

|

–

–

|

+114

-137

|

+2.5 (-105)

-2.5 (-115)

|

O 47.5 (-115)

U 47.5 (-105)

|

|

|

Sep 12, 2026 12:00PM EDT

Oklahoma Sooners

Michigan Wolverines

9/12/26 12PM

OKLA

MICH

|

–

–

|

-102

-118

|

+1.5 (-110)

-1.5 (-110)

|

O 45.5 (-110)

U 45.5 (-110)

|

CFB Past Picks

Remi—our in-house AI—prices every game and prop using multi-season priors, tempo/efficiency, injury/usage signals, and market movement.

We publish fair prices, recommended “buy-to” numbers, and confidence so you can bet prices, not teams.

This preview covers Duke Blue Devils vs. North Carolina Tar Heels on November 22, 2025 at Kenan Stadium.

Odds shown reflect widely available numbers and may update closer to kickoff.

Want more? Check live edges, player props, and line moves on our CFB odds pages, and compare prices before you place a bet.

|

|

|

|

RESULT | |

|---|---|---|---|---|

| OREG@IND | IND -3 | 53.4% | 2 | WIN |

| OLEMISS@GEORGIA | KEWAN LACY ANYTIME TD | 56.7% | 6 | WIN |

| BAMA@IND | FERNANDO MENDOZA UNDER 26.5 PASS ATT | 55.2% | 5 | WIN |

| OREG@TXTECH | OREG -126 | 58.9% | 6 | WIN |

| MICH@TEXAS | TEXAS -6 | 53.3% | 1 | WIN |

| MIAMI@OHIOST | UNDER 40.5 | 53.6% | 2 | WIN |

| NEB@UTAH | DEVON DAMPIER UNDER 185.5 PASS YDS | 53.4% | 3 | LOSS |

| IOWA@VANDY | IOWA +4.5 | 53.1% | 2 | WIN |

| NOTEX@SDGST | NOTEX -7 | 54.2% | 4 | LOSS |

| TULANE@OLEMISS | OLEMISS -16.5 | 53.4% | 1 | WIN |

| MIAMI@TEXA&M | TEXA&M -3 | 54.1% | 3 | LOSS |

| BAMA@OKLA | BAMA +1.5 | 52.1% | 1 | WIN |

| BAMA@OKLA | ISAIAH SATEGNA III ANYTIME TD | 54.2% | 4 | WIN |

| BYU@TTU | PARKER KINGSTON OVER 20.5 LONGEST RECEPTION | 54.3% | 4 | WIN |

| UNLV@BOISE | BOISE -4.5 | 56.7% | 6 | WIN |

| OHIOST@MICH | UNDER 44 | 52.8% | 2 | WIN |

| ECU@FAU | FAU +7 | 57.8% | 7 | LOSS |

| OREG@WASH | WASH +7 | 54.9% | 4 | LOSS |

| WYO@HAWAII | WYO +7.5 | 55.1% | 5 | LOSS |

| COLO@KSTATE | COLO +17.5 | 54.0% | 4 | WIN |

| PSU@RUT | RUT +14 | 52.8% | 1 | WIN |

| OHIOST@MICH | MICH +10.5 | 56.4% | 6 | LOSS |

| VATECH@UVA | VATECH +8 | 57.8% | 7 | LOSS |

| NWEST@ILL | LUKE ALTMYER UNDER 19.5 PASS COMP | 54.3% | 4 | WIN |

| ORE@WAS | DEMOND WILLIAMS JR UNDER 43.5 RUSH YDS | 55.2% | 5 | WIN |

| MIAMI@VATECH | VATECH +18.5 | 54.2% | 4 | WIN |

| GAST@TROY | TROY -9.5 | 55.7% | 5 | WIN |

| DEL@WAKE | DEL +18 | 56.7% | 6 | LOSS |

| NMEX@AF | NMEX -3.5 | 56.1% | 5 | WIN |

| WASHST@JMAD | WASHST +14.5 | 55.3% | 5 | WIN |

| ILL@WISC | WISC +9 | 55.1% | 5 | WIN |

| WKY@LSU | WKY +23.5 | 56.3% | 6 | WIN |

| WASH@UCLA | DEMOND WILLIAMS UNDER 27.5 PASS ATT | 56.3% | 6 | WIN |

| TCU@HOU | AMARE THOMAS OVER 69.5 RECV YDS | 55.2% | 5 | WIN |

| TEX@UGA | NATE FRAZIER UNDER 65.5 RUSH + REC YDS | 55.5% | 5 | WIN |

| PUR@WASH | ANTONIO HARRIS UNDER 73.5 RUSH + REC YDS | 54.1% | 4 | WIN |

| OKLA@BAMA | UNDER 46 | 52.4% | 2 | WIN |

| UVA@DUKE | DUKE -3.5 | 54.7% | 3 | LOSS |

| OKLA@BAMA | BAMA -6 | 54.5% | 3 | LOSS |

| OREGST@TULSA | OREGST -120 | 55.6% | 5 | LOSS |

| UTEP@MIZZST | MIZZST -5 | 54.3% | 4 | WIN |

| COLOST@NMEX | NMEX -14 | 57.1% | 6 | LOSS |

| PSU@MICHST | MICHST +7.5 | 56.5% | 6 | LOSS |

| MISSST@MIZZOU | MISSST +7.5 | 57.2% | 7 | LOSS |

| FAU@TULANE | FAU +17.5 | 56.0% | 6 | WIN |

| NCST@MIAMI | NCST +15.5 | 57.1% | 7 | LOSS |

| KENTST@AKRON | AKRON -6.5 | 55.4% | 5 | LOSS |

| JAXST@UTEP | JAXST -105 | 57.0% | 7 | WIN |

| FSU@CLEM | CLEM -118 | 57.1% | 5 | WIN |

| UNLV@COLOST | UNLV -4 | 55.2% | 5 | WIN |

| OREG@IOWA | IOWA +6.5 | 53.3% | 2 | WIN |