Arizona vs Colorado Prediction — AI Finds CAN'T MISS CFB Lines & Props (Nov 01)

Updated: 2025-10-25T02:28:40.156150ZBy Remi at Leans.AI — AI picks for ATS, ML, OU & props

The Arizona Wildcats travel to face the Colorado Buffaloes on November 1, 2025 at Folsom Field in Boulder in a Big 12 matchup where Arizona seeks to rebound after a rough start to its conference campaign while Colorado looks to assert itself at home under new direction. Arizona enters having struggled in its first year in the Big 12, and Colorado is still navigating transition but carries momentum and home-field advantage.

Get key insights, betting trends, and AI-powered predictions to help incorporate into your betting strategies.

GAME INFO

Date: Nov 01, 2025

Start Time: 7:00 PM EST

Venue: Folsom Field

Buffaloes Record: (3-5)

Wildcats Record: (4-3)

OPENING ODDS

ARIZ Moneyline: -195

COLO Moneyline: +162

ARIZ Spread: -4.5

COLO Spread: +4.5

Over/Under: 52.5

ARIZ

Betting Trends

- Arizona posted just a 2–10 record ATS in the 2024 season as they struggled with roster turnover and conference shift.

COLO

Betting Trends

- Colorado finished the 2024 season 9–4 ATS, showing strong value in the market despite a U-season outcome.

MATCHUP TRENDS

- Arizona’s poor ATS history as road underdogs offers value for Colorado at home. The Buffaloes opening as ~ +5 underdogs indicates market respect for Arizona’s potential, but Colorado’s home cover-history and momentum suggest the value may lie with the home team. The total around 52.5 points suggests expectations for a moderate scoring affair—if Arizona’s offense remains inconsistent the under may be attractive.

ARIZ vs. COLO

Best Prop Bet

- Remi's searched hard and found the best prop for this matchup: O. Miller under 59.5 Receiving Yards.

LIVE CFB ODDS

CFB ODDS COMPARISON

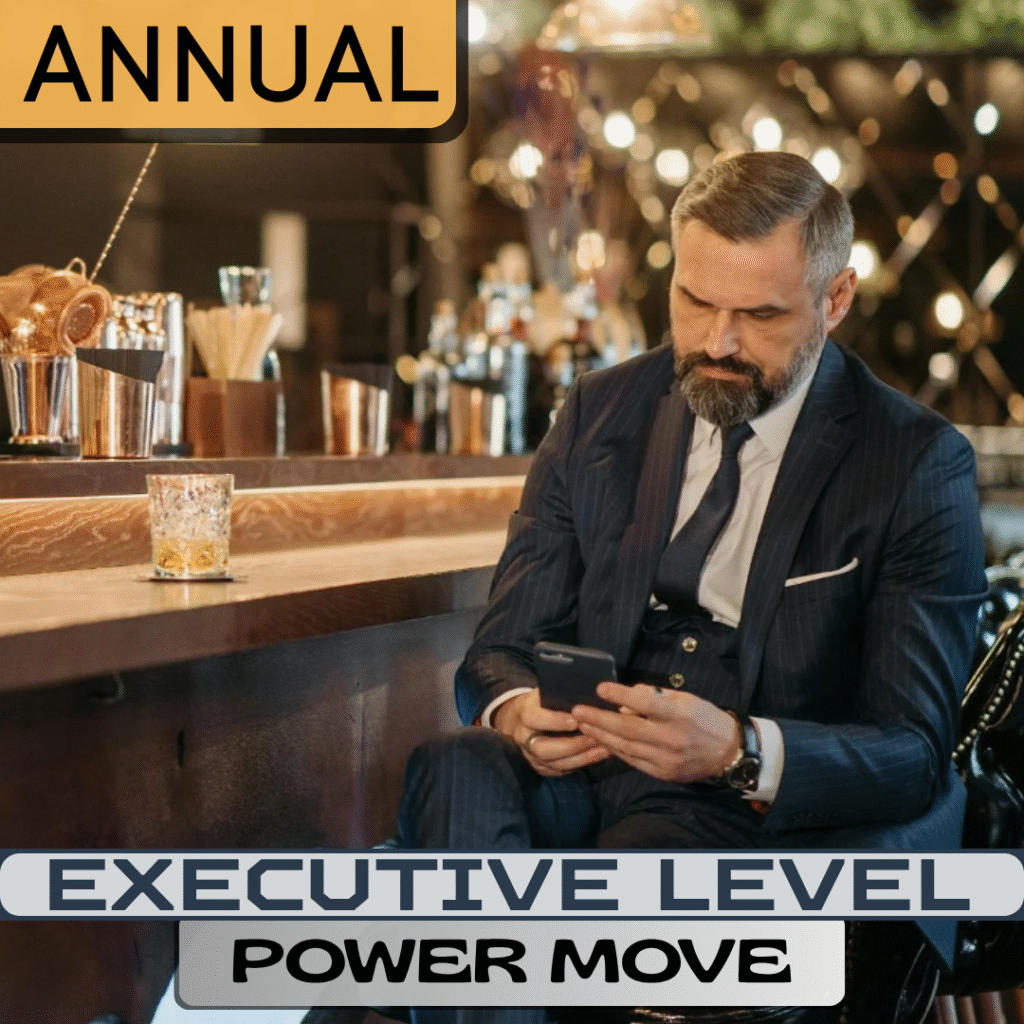

WANT MORE AI PICKS?

VS. SPREAD

374-287

NET UNITS

(INCL VIG & EXEC)

+829.4

NET PROFIT

(INCL VIG & EXEC)

$100/UNIT

$82,943

VS. SPREAD

1680-1416

NET UNITS

(INCL VIG)

+450.6

NET PROFIT

(INCL VIG)

$100/UNIT

$45,057

AI SPORTS PICK PRODUCTS

Create a Free Account

‘Create an Account’ to Get Remi’s Picks Today.

‘Create an Account’ to Get Remi’s Picks Today. Remi Finds New Picks

Remi calculates the probability a team will cover the line.

Remi calculates the probability a team will cover the line. Remi Works 24/7

Remi uses this probability to assign units to each pick.

Remi uses this probability to assign units to each pick.

Get Remi's AI Picks

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Get Remi’s Top AI Sports Picks sent direct to your inbox.

Hedge Meaning in Betting | 4 Obvious Times to Hedge

Learn about hedge betting to manage risk and secure profits. Understand...

What is a Push in Betting? | 3 Ways To Use To Your Advantage

Understand what a push in betting means, how it happens in...

What Does the + and – Mean in Sports Betting? | 5 Easy Tips

Learn the basics of sports betting odds, what the plus (+)...

Arizona vs Colorado Prediction & Odds:

Free CFB Betting Insights for 11/1/25

The November 1, 2025 matchup between the Arizona Wildcats and the Colorado Buffaloes at Folsom Field in Boulder promises to be a fascinating clash between two programs navigating rebuilding paths in the evolving landscape of the Big 12. For Arizona, this trip represents both an opportunity and a test—a chance to prove that new head coach Brent Brennan’s methodical rebuild is starting to take hold, and a reminder of how difficult life can be on the road in one of college football’s most unique environments. The Wildcats enter the game in the midst of a transitional year after a turbulent 2024 campaign that saw them struggle in nearly every phase of the game, especially against the spread where they finished 2–10 ATS. Brennan has emphasized discipline and fundamentals over flash, seeking to stabilize a team that has been plagued by turnovers, inconsistent quarterback play, and poor defensive execution. Offensively, Arizona’s hopes ride on the arm and decision-making of quarterback Noah Fifita, who returns as one of the few bright spots from last season. Fifita is a capable passer with good anticipation and timing, but his efficiency has often been undermined by a porous offensive line and an inconsistent running game. His connection with wideout Tetairoa McMillan remains the offense’s most potent weapon—a combination capable of explosive plays but reliant on sustained drives and better balance. The Wildcats’ offensive line remains a work in progress, struggling to establish a push in the run game or protect in obvious passing situations, something Colorado’s aggressive defensive front will look to exploit. Running back DJ Williams will need to find rhythm early to help Arizona avoid becoming one-dimensional, as playing from behind has been a recipe for disaster for this team.

Defensively, Arizona has shown flashes of improvement under new coordinator Chuck Morrell, particularly in the secondary where safety Gunner Maldonado and cornerback Tacario Davis bring experience and athleticism. However, the front seven remains a vulnerability, often losing the line of scrimmage against physical opponents—a major concern facing a Colorado team that thrives on tempo and offensive versatility. On the other side, Deion Sanders’ Colorado program enters 2025 with a renewed sense of purpose and focus. After an up-and-down 2024 that saw moments of brilliance but ended short of postseason glory, the Buffaloes are determined to build consistency and toughness to complement their dynamic style. With new quarterback Kaidon Salter taking over the offense, Colorado retains its explosive DNA but adds a more composed and balanced dimension. Salter’s dual-threat ability provides a challenge for opposing defenses, and his connection with wide receivers Travis Hunter and Jimmy Horn Jr. gives Colorado multiple vertical and underneath options. Running back Alton McCaskill anchors a backfield built on speed and patience, giving the Buffaloes flexibility to attack Arizona’s weak run defense. The Colorado defense, meanwhile, has quietly become a strength under coordinator Charles Kelly. With transfers fortifying the front seven and Sanders emphasizing accountability and tackling fundamentals, the Buffaloes enter this game with improved depth and discipline. Their secondary, featuring Hunter and safety Shilo Sanders, is athletic and opportunistic, capable of turning over opposing quarterbacks who press for big plays. From a betting perspective, this game carries interesting angles: Colorado, who finished 9–4 ATS in 2024, has become one of the more reliable home teams in the nation for bettors, while Arizona’s struggles against the number make them a risky pick on the road. The spread is likely to favor Colorado by around 6–7 points, and given the Wildcats’ offensive inconsistency, the Buffaloes’ defense could be the deciding factor in both the outcome and the cover. The total may hover in the low-to-mid 50s, making tempo control critical; if Arizona can drag the game into a slower, grind-it-out style, the under could hit, but if Colorado dictates pace, the scoreboard could light up quickly. Ultimately, this matchup feels like one that will define momentum for both programs heading into November—Arizona seeking validation in year one of a rebuild, and Colorado striving to prove that its resurgence under Sanders is not just about hype, but sustainability.

Get live CFB odds and precise AI CFB picks, predictions, and cover probabilities.

cats are back 😼

— Arizona Football (@ArizonaFBall) October 27, 2025

⏰ 4:00 PM MST

🏟️ Folsom Field

📺 FS1

📻 Wildcats Radio 1290 pic.twitter.com/3BmW1C5iEZ

Arizona Wildcats CFB Preview

The Arizona Wildcats travel to Boulder for their November 1, 2025 showdown against the Colorado Buffaloes with a sense of urgency and quiet determination, knowing that their first full year in the Big 12 has been a roller coaster filled with growing pains and lessons in patience. Under new head coach Brent Brennan, Arizona is in the midst of a full rebuild, seeking to re-establish the foundation that was lost during the program’s difficult 2024 campaign. The Wildcats finished that season with one of the worst records in the conference and an abysmal 2–10 ATS mark, a reflection of how inconsistent and unpredictable they were on both sides of the ball. Brennan’s approach has been methodical, emphasizing toughness, player development, and system discipline rather than relying on high-risk, high-reward football. His biggest project has been quarterback Noah Fifita, who returns as the offensive centerpiece and team leader. Fifita has proven that he has the talent to compete at this level—he’s accurate, mobile enough to extend plays, and shows good anticipation—but he has struggled to find rhythm behind an offensive line that has often looked overwhelmed. The Wildcats’ success offensively hinges on whether that line can keep Fifita upright and open lanes for the run game, something that has been missing in recent seasons. Running back DJ Williams, a physical runner with good burst, has the ability to shoulder the load, but Arizona’s lack of consistency up front has often neutralized his impact. The passing game will continue to center around Fifita’s connection with wide receiver Tetairoa McMillan, a legitimate star who combines length, body control, and elite hands to stretch defenses vertically and create matchup problems for any secondary.

When McMillan gets rolling, Arizona’s offense looks competent and dangerous; when defenses key on him and Fifita is forced to spread the ball to less proven targets, drives stall and turnovers increase. Defensively, the Wildcats have made modest strides under new coordinator Chuck Morrell, but there’s still a long way to go before this group can contend with the more physical and explosive teams in the Big 12. Their biggest issue remains up front, where the defensive line has struggled to generate pressure or consistently stop the run. Without that disruption, the defense has been forced into too many third-and-long situations, leading to breakdowns in coverage and fatigue. The secondary, however, is the strength of the unit, led by cornerbacks Tacario Davis and Ephesians Prysock, who both possess size and physicality that can challenge opposing receivers. They’ll be tested heavily in this game against Colorado’s deep and athletic wideout corps, particularly with the Buffaloes’ willingness to take vertical shots early and often. Arizona’s defensive success will depend on limiting big plays, tackling in space, and forcing Colorado’s new quarterback Kaidon Salter to sustain long drives without mistakes. From a mental standpoint, the Wildcats must find composure on the road, as the altitude and noise at Folsom Field can overwhelm less seasoned teams. Special teams could also play an underrated role here, with Arizona needing to control field position to keep the defense fresh and the offense within striking distance. From a betting perspective, the Wildcats’ poor performance against the spread—especially as road underdogs—makes them a difficult team to trust. However, this game provides an opportunity for Arizona to show measurable progress under Brennan, even if victory remains an uphill battle. To stay competitive, they must minimize penalties, protect the football, and win time of possession, turning this contest into a battle of patience rather than pace. For a program searching for identity and respect in a new conference, even a strong showing against a surging Colorado squad could represent a meaningful step forward in their long-term climb back to relevance.

Credit: USA TODAY/IMAGN

Colorado Buffaloes CFB Preview

The Colorado Buffaloes return to Folsom Field on November 1, 2025, to host Arizona in a matchup that offers another chance to demonstrate how far the program has come under head coach Deion “Coach Prime” Sanders. After an electrifying but uneven 2024 campaign that ended with a 9–4 ATS record and glimpses of genuine progress, Colorado enters this season with elevated expectations and a renewed sense of control. The Buffaloes have transitioned from a team powered by star personalities to one that operates with greater balance, physicality, and depth—precisely what Sanders envisioned when he took over two years ago. The biggest storyline in Boulder has been the development of new quarterback Kaidon Salter, the former Liberty standout whose dual-threat ability fits seamlessly into Sanders’ fast-paced, aggressive offensive philosophy. Salter brings experience, leadership, and poise, offering Colorado a confident signal-caller capable of both orchestrating long drives and delivering explosive plays downfield. His connection with wide receivers Travis Hunter and Jimmy Horn Jr. provides an elite one-two punch, while tight end Michael Harrison offers a reliable target in short-yardage and red-zone situations. The running game, often overlooked in 2024, has become a renewed focus this year, with Alton McCaskill emerging as a steady presence who can grind out tough yards and create balance in the offense. Offensive coordinator Sean Lewis has worked to install a more efficient version of the Buffaloes’ tempo attack—one that prioritizes sustained drives and time of possession rather than purely chasing highlight-reel moments. This shift has allowed Colorado to protect its defense while maintaining its signature explosiveness. On the defensive side, the Buffaloes have evolved from a liability into one of the more promising units in the Big 12.

Defensive coordinator Charles Kelly has crafted a system built on aggression and speed, emphasizing turnovers, gap discipline, and tackling fundamentals. The front seven, led by linebacker Jordan Domineck and defensive end Taijh Alston, has shown significant improvement in controlling the line of scrimmage, something that will be crucial against an Arizona offense that thrives on quick passes and timing routes. The secondary, headlined by two-way star Travis Hunter and safety Shilo Sanders, is the heart of the defense—a confident, athletic group that excels at jumping routes and creating takeaways. Colorado’s defensive focus will be on disrupting Arizona quarterback Noah Fifita’s rhythm, using disguised blitzes to pressure him while relying on their corners to hold up in single coverage. At home, the Buffaloes have proven difficult to beat, buoyed by one of the most passionate crowds in college football and the unique challenge of Boulder’s altitude. Since Sanders’ arrival, Folsom Field has regained its identity as a true home-field advantage where opponents often wilt under the combination of energy, pace, and atmosphere. The betting numbers back that up—Colorado has covered in eight of its last twelve home games and tends to play with confidence early, often setting the tone before opponents can adjust. For this matchup, Colorado’s edge lies in its ability to dictate tempo and control the game script. If Salter can establish the passing attack early and McCaskill can keep the chains moving, the Buffaloes should be able to wear down an Arizona defense that has struggled with depth and tackling consistency. The key will be avoiding turnovers and maintaining focus—areas that cost Colorado winnable games last season. From a betting standpoint, Colorado likely enters as a moderate home favorite, perhaps around -6.5, given their strong ATS history and offensive advantages. The total could push into the mid-50s, making the over appealing if both quarterbacks settle in quickly. Still, Sanders has emphasized complementary football, so expect a more controlled, efficient approach than the high-variance shootouts of 2023 and 2024. With improved balance, a mature quarterback, and a defensive unit capable of dictating pressure, Colorado is well-positioned not only to win but to make another statement that its transformation under Coach Prime is not just hype—it’s real, sustainable, and still ascending.

let’s get right. pic.twitter.com/lt0vZj1rGE

— Colorado Buffaloes Football (@CUBuffsFootball) October 28, 2025

Arizona vs Colorado Prop Picks (AI)

AI algorithm Remi is pouring through mountains of data on each player. In fact, anytime the Wildcats and Buffaloes play there’s always several intriguing angles to key in on. Not to mention games played at Folsom Field in Nov almost always follow normal, predictable patterns.

Arizona vs Colorado Prediction (AI)

Remi, our AI sports genius, has been pouring over exorbitant amounts of data from every facet between the Wildcats and Buffaloes and using recursive machine learning and kick-ass AI to examine the data to a single cover probability.

Remi has been most focused on the unproportionally assigned emphasis human bettors tend to put on player performance factors between a Wildcats team going up against a possibly tired Buffaloes team. In reality, the true game analytics appear to reflect a moderate lean against one Vegas line specifically.

Unlock this in-depth AI prediction and all of our CFB AI picks for FREE now.

Below is our current AI Arizona vs Colorado picks, computer picks Wildcats vs Buffaloes, best bets, model edges, confidence ratings.

| DATE | GAME | LEAN | %WIN | UNITS | LEVEL | |

|---|---|---|---|---|---|---|

| ACTIVE PICKS LOCKED - SEE NOW | ||||||

These picks update as information changes—injury reports, and market movement. Each line shows our model’s fair price, the edge versus the market, and a unit confidence rating (1–10). Odds and availability vary by sportsbook and time. Edges are computed against the listed price; value may change after line moves. Always shop for the best number. See the full CFB schedule.

Arizona Betting Trends

Arizona posted just a 2–10 record ATS in the 2024 season as they struggled with roster turnover and conference shift.

Colorado Betting Trends

Colorado finished the 2024 season 9–4 ATS, showing strong value in the market despite a U-season outcome.

Wildcats vs. Buffaloes Matchup Trends

Arizona’s poor ATS history as road underdogs offers value for Colorado at home. The Buffaloes opening as ~ +5 underdogs indicates market respect for Arizona’s potential, but Colorado’s home cover-history and momentum suggest the value may lie with the home team. The total around 52.5 points suggests expectations for a moderate scoring affair—if Arizona’s offense remains inconsistent the under may be attractive.

Arizona vs. Colorado Game Info

Arizona vs Colorado starts on November 01, 2025 at 7:00 PM EST.

Venue: Folsom Field.

Spread: Colorado +4.5

Moneyline: Arizona -195, Colorado +162

Over/Under: 52.5

Arizona: (4-3) | Colorado: (3-5)

Remi's searched hard and found the best prop for this matchup: O. Miller under 59.5 Receiving Yards.. Prices move—always shop for the best number.

Arizona’s poor ATS history as road underdogs offers value for Colorado at home. The Buffaloes opening as ~ +5 underdogs indicates market respect for Arizona’s potential, but Colorado’s home cover-history and momentum suggest the value may lie with the home team. The total around 52.5 points suggests expectations for a moderate scoring affair—if Arizona’s offense remains inconsistent the under may be attractive.

ARIZ trend: Arizona posted just a 2–10 record ATS in the 2024 season as they struggled with roster turnover and conference shift.

COLO trend: Colorado finished the 2024 season 9–4 ATS, showing strong value in the market despite a U-season outcome.

See our latest CFB picks and odds pages for 2025 to compare prices before you bet.

Arizona vs. Colorado Odds

Remi is pouring through loads of data on each line. In fact, anytime the Arizona vs Colorado trends are analyzed, there’s always several intriguing trends to key in on. Not to mention games played at extreme temps seemingly never follow normal, predictable betting trends.

| ARIZ Moneyline | -195 |

|---|---|

| COLO Moneyline | +162 |

| ARIZ Spread | -4.5 |

| COLO Spread | +4.5 |

| Over / Under | 52.5 |

Arizona vs Colorado Live Odds

| Games | PTS | ML | SPR | O/U | |

|---|---|---|---|---|---|

|

Dec 5, 2025 7:00PM EST

Troy Trojans

James Madison Dukes

12/5/25 7PM

TROY

JMAD

|

–

–

|

+1300

-2500

|

+23.5 (-108)

-23.5 (-112)

|

O 46.5 (-110)

U 46.5 (-110)

|

|

|

Dec 5, 2025 7:00PM EST

Kennesaw State Owls

Jacksonville State Gamecocks

12/5/25 7PM

KENSAW

JAXST

|

–

–

|

-136

+116

|

-2.5 (-110)

+2.5 (-110)

|

O 60.5 (-110)

U 60.5 (-110)

|

|

|

Dec 5, 2025 8:00PM EST

North Texas Mean Green

Tulane Green Wave

12/5/25 8PM

NOTEX

TULANE

|

–

–

|

-130

+110

|

-2.5 (-112)

+2.5 (-108)

|

O 66.5 (-115)

U 66.5 (-105)

|

|

|

Dec 5, 2025 8:01PM EST

UNLV Rebels

Boise State Broncos

12/5/25 8:01PM

UNLV

BOISE

|

–

–

|

+184

-220

|

+5.5 (-110)

-5.5 (-110)

|

O 58.5 (-115)

U 58.5 (-105)

|

|

|

Dec 6, 2025 12:00PM EST

Miami Ohio Redhawks

Western Michigan Broncos

12/6/25 12PM

MIAOH

WMICH

|

–

–

|

-132

|

-1.5 (-115)

|

O 42.5 (-115)

U 42.5 (-105)

|

|

|

Dec 6, 2025 12:00PM EST

BYU Cougars

Texas Tech Red Raiders

12/6/25 12PM

BYU

TXTECH

|

–

–

|

+430

-560

|

+12.5 (-105)

-12.5 (-115)

|

O 49.5 (-108)

U 49.5 (-112)

|

|

|

Dec 6, 2025 4:00PM EST

Georgia Bulldogs

Alabama Crimson Tide

12/6/25 4PM

UGA

BAMA

|

–

–

|

-134

+114

|

-2.5 (-115)

+2.5 (-105)

|

O 48.5 (-106)

U 48.5 (-114)

|

|

|

Dec 6, 2025 8:00PM EST

Duke Blue Devils

Virginia Cavaliers

12/6/25 8PM

DUKE

UVA

|

–

–

|

+156

-186

|

+3.5 (-102)

-3.5 (-120)

|

O 57.5 (-115)

U 57.5 (-105)

|

|

|

Dec 6, 2025 8:01PM EST

Indiana Hoosiers

Ohio State Buckeyes

12/6/25 8:01PM

IND

OHIOST

|

–

–

|

+158

-188

|

+4.5 (-115)

-4.5 (-105)

|

O 47.5 (-114)

U 47.5 (-106)

|

|

|

Dec 13, 2025 3:00PM EST

Army Black Knights

Navy Midshipmen

12/13/25 3PM

ARMY

NAVY

|

–

–

|

+172

-210

|

+4.5 (-105)

-4.5 (-115)

|

O 38.5 (-110)

U 38.5 (-110)

|

CFB Past Picks

Remi—our in-house AI—prices every game and prop using multi-season priors, tempo/efficiency, injury/usage signals, and market movement.

We publish fair prices, recommended “buy-to” numbers, and confidence so you can bet prices, not teams.

This preview covers Arizona Wildcats vs. Colorado Buffaloes on November 01, 2025 at Folsom Field.

Odds shown reflect widely available numbers and may update closer to kickoff.

Want more? Check live edges, player props, and line moves on our CFB odds pages, and compare prices before you place a bet.

| LEAN | %WIN | UNITS | RESULT | |

|---|---|---|---|---|

| COLO@KSTATE | COLO +17.5 | 54.0% | 4 | WIN |

| PSU@RUT | RUT +14 | 52.8% | 1 | WIN |

| OHIOST@MICH | MICH +10.5 | 56.4% | 6 | LOSS |

| VATECH@UVA | VATECH +8 | 57.8% | 7 | LOSS |

| NWEST@ILL | LUKE ALTMYER UNDER 19.5 PASS COMP | 54.3% | 4 | WIN |

| ORE@WAS | DEMOND WILLIAMS JR UNDER 43.5 RUSH YDS | 55.2% | 5 | WIN |

| MIAMI@VATECH | VATECH +18.5 | 54.2% | 4 | WIN |

| GAST@TROY | TROY -9.5 | 55.7% | 5 | WIN |

| DEL@WAKE | DEL +18 | 56.7% | 6 | LOSS |

| NMEX@AF | NMEX -3.5 | 56.1% | 5 | WIN |

| WASHST@JMAD | WASHST +14.5 | 55.3% | 5 | WIN |

| ILL@WISC | WISC +9 | 55.1% | 5 | WIN |

| WKY@LSU | WKY +23.5 | 56.3% | 6 | WIN |

| WASH@UCLA | DEMOND WILLIAMS UNDER 27.5 PASS ATT | 56.3% | 6 | WIN |

| TCU@HOU | AMARE THOMAS OVER 69.5 RECV YDS | 55.2% | 5 | WIN |

| TEX@UGA | NATE FRAZIER UNDER 65.5 RUSH + REC YDS | 55.5% | 5 | WIN |

| PUR@WASH | ANTONIO HARRIS UNDER 73.5 RUSH + REC YDS | 54.1% | 4 | WIN |

| OKLA@BAMA | UNDER 46 | 52.4% | 2 | WIN |

| UVA@DUKE | DUKE -3.5 | 54.7% | 3 | LOSS |

| OKLA@BAMA | BAMA -6 | 54.5% | 3 | LOSS |

| OREGST@TULSA | OREGST -120 | 55.6% | 5 | LOSS |

| UTEP@MIZZST | MIZZST -5 | 54.3% | 4 | WIN |

| COLOST@NMEX | NMEX -14 | 57.1% | 6 | LOSS |

| PSU@MICHST | MICHST +7.5 | 56.5% | 6 | LOSS |

| MISSST@MIZZOU | MISSST +7.5 | 57.2% | 7 | LOSS |

| FAU@TULANE | FAU +17.5 | 56.0% | 6 | WIN |

| NCST@MIAMI | NCST +15.5 | 57.1% | 7 | LOSS |

| KENTST@AKRON | AKRON -6.5 | 55.4% | 5 | LOSS |

| JAXST@UTEP | JAXST -105 | 57.0% | 7 | WIN |

| FSU@CLEM | CLEM -118 | 57.1% | 5 | WIN |

| UNLV@COLOST | UNLV -4 | 55.2% | 5 | WIN |

| OREG@IOWA | IOWA +6.5 | 53.3% | 2 | WIN |

| NEB@UCLA | NEB +1.5 | 55.8% | 5 | WIN |

| KENSAW@NMEXST | NMEXST +10 | 56.5% | 6 | WIN |

| STNFRD@UNC | STNFRD +7.5 | 53.8% | 3 | WIN |

| DUKE@UCONN | UCONN +8.5 | 57.9% | 7 | WIN |

| NEVADA@UTAHST | NEVADA +9.5 | 55.9% | 5 | LOSS |

| SAMST@OREGST | SAMST +21 | 57.7% | 7 | WIN |

| NEB@UCLA | NICO IAMALEAVA UNDER 180.5 PASS YDS | 56.6% | 6 | LOSS |

| HOU@UCF | HOU -112 | 58.0% | 6 | WIN |

| GASTHRN@APPST | GASTHRN +180 | 36.5% | 2 | WIN |

| KENTST@BALLST | BALLST -2.5 | 54.5% | 4 | WIN |

| WAKE@FSU | WAKE +10.5 | 56.4% | 6 | LOSS |

| WYO@SDGST | SDGST -10.5 | 56.7% | 7 | WIN |

| OKLA@TENN | TENN -130 | 58.3% | 5 | LOSS |

| GATECH@NCST | GATECH -5 | 56.4% | 6 | LOSS |

| MIAMI@SMU | MIAMI -10 | 54.3% | 4 | LOSS |

| IND@MD | MD +21.5 | 54.6% | 4 | LOSS |

| CINCY@UTAH | CINCY +11 | 57.6% | 7 | LOSS |

| OLDDOM@LAMON | LAMON +17 | 58.4% | 8 | LOSS |

| VANDY@TEXAS | OVER 46.5 | 53.7% | 2 | WIN |